Consolidated Investment Program

The 2012 consolidated investment program of the Company takes account of Holding subsidiaries’ current capex programs approved in accordance with Resolution of the Government of the Russian Federation No. 977 of December 1, 2009, including with respect to the facilities necessary for power supply for preparations for and holding of the 2014 Winter Olympics in Sochi.

The capex programs of Holding subsidiaries take into consideration the following principal requirements:

- Compliance of investment projects with the models and programs of electricity industry development of the of the constituent entities of the Russian Federation (prepared and approved in accordance with Resolution of the Government of the Russian Federation No. 823 of January 17, 2009) or the models of 0.38–20 kV electric grid facility development (if available);

- Inclusion of the facilities initiated in the previous years;

- Inclusion of the facilities intended for preventing (reducing) long-lasting power outages that affect socially important facilities and vital infrastructure;

- Inclusion of the facilities in an unsatisfactory technical condition, whose routine maintenance and repair are economically and technically infeasible;

- Inclusion of the facilities from target-oriented programs;

- Ensuring that metering instruments close boundaries with large customers, including the 100% closing of boundaries with consumers of over 750 kVA and allied grid organizations (TGOs);

- Implementation of measures to build/modernize the Automated Information System of Electricity Billing Metering of the Retail Electricity Market at metering points;Inclusion of the facilities necessary to perform obligations under network connection contracts; inclusion of the facilities ensuring that generators deliver capacity under capacity supply agreements.

Furthermore, pursuant to Resolution of the Government of the Russian Federation No. 977 of December 1, 2009, the consolidated investment program contains the facilities ensuring the implementation of the following programs:

- Energy conservation and energy efficiency enhancement;

- Creation of the system of automated emergency and process control equipment;

- Implementation of programs for creating the telecontrol and communication system;

- Installation of voltage regulators and reactive power compensators.

The Company subsidiaries’ capital investment is the capital expenditures that include expenses related to new construction; rehabilitation, expansion, and technical upgrading of production and non-production facilities; acquisition of buildings, structures, equipment, land, and facilities intended for the use of natural resources; acquisition and creation of intangible assets, and other capital investment expenses.

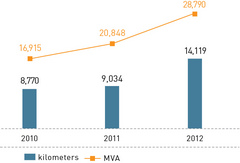

In 2012, the amount of invested funds was 136,459 million rubles (exclusive of VAT), with financing of 148,577 million rubles (inclusive of VAT), while commissioned fixed assets totaled 137,229 million rubles. Commissioned capacity in 2012 reached 14,119 MVA and 28,790 kilometers.

KEY INDICATORS OF THE CONSOLIDATED INVESTMENT PROGRAM IN 2012

| Company | Capital Investment (million rubles, exclusive of VAT) | Financing (million rubles, inclusive of VAT) | Commissioned Fixed Assets (million rubles, exclusive of VAT) | Commissioned Fixed Assets (MVA) | Commissioned Fixed Assets (kilometers) |

|---|---|---|---|---|---|

| IDGC of Siberia | 4,995 | 5,867 | 6,372 | 633 | 1,487 |

| TDC | 397 | 551 | 401 | 115 | 793 |

| Tyumenenergo | 10,904 | 9,293 | 11,417 | 865 | 716 |

| IDGC of Urals | 7,037 | 7,898 | 6,863 | 621 | 1,242 |

| IDGC of Volga | 9,246 | 11,089 | 8,741 | 780 | 1,753 |

| IDGC of South | 5,127 | 5,223 | 3,455 | 203 | 1,316 |

| Kubanenergo | 8,523 | 9,158 | 4,587 | 666 | 241 |

| IDGC of Northern Caucasus | 5,504 | 5,830 | 3,186 | 242 | 1,469 |

| NURENERGO | 243 | 339 | 177 | 31 | 178 |

| IDGC of Center and Volga Region | 9,458 | 10,873 | 10,049 | 693 | 3,603 |

| IDGC of North-West | 6,792 | 8,157 | 6,277 | 469 | 1,836 |

| LENENERGO | 14,891 | 16,000 | 16,075 | 1,911 | 1,581 |

| Yantarenergo | 420 | 517 | 434 | 23 | 105 |

| IDGC of Centre | 15,847 | 19,193 | 16,929 | 1,518 | 8,026 |

| MOESK | 36,095 | 37,425 | 39,095 | 4,792 | 4,320 |

| Tyvaenergo | 108 | 71 | 69 | 5 | 34 |

| ENCE | 872 | 1,095 | 3,101 | 553 | 90 |

| Total for Holding | 136,459 | 148,577 | 137,229 | 14,119 | 28,790 |

CHANGES IN COMMISSIONED CAPACITY UNDER THE CONSOLIDATED INVESTMENT PROGRAM FOR 2010–2012

| Company | 2010 | 2011 | 2012 | |||

|---|---|---|---|---|---|---|

| MVA | kilometers | MVA | kilometers | MVA | kilometers | |

| IDGC of Siberia | 424 | 1,060 | 349 | 1,548 | 633 | 1,487 |

| TDC | 85 | 627 | 5 | 43 | 115 | 793 |

| Tyumenenergo | 741 | 256 | 624 | 166 | 865 | 716 |

| IDGC of Urals | 669 | 1,670 | 424 | 1,169 | 621 | 1,242 |

| IDGC of Volga | 520 | 1,144 | 700 | 1,544 | 780 | 1,753 |

| IDGC of South | 296 | 467 | 408 | 1,185 | 203 | 1,316 |

| Kubanenergo | 265 | 166 | 258 | 240 | 666 | 241 |

| IDGC of Northern Caucasus | 216 | 600 | 316 | 845 | 242 | 1,469 |

| NURENERGO | 64 | 49 | 41 | 200 | 31 | 178 |

| IDGC of Center and Volga Region | 711 | 2,226 | 1264 | 3,086 | 693 | 3,603 |

| IDGC of North-West | 299 | 897 | 540 | 1,485 | 469 | 1,836 |

| LENENERGO | 932 | 1,508 | 996 | 1,713 | 1,911 | 1,581 |

| Yantarenergo | 126 | 64 | 118 | 154 | 23 | 105 |

| IDGC of Centre | 1,050 | 4,155 | 1490 | 4,630 | 1,518 | 8,026 |

| MOESK | 2,276 | 2,005 | 1597 | 2,726 | 4,792 | 4,320 |

| Tyvaenergo | 0 | 0 | 9 | 61 | 5 | 34 |

| ENCE | 95 | 22 | 166 | 52 | 553 | 90 |

| Total for Holding | 8,770 | 16,915 | 9,304 | 20,848 | 14,119 | 28,790 |

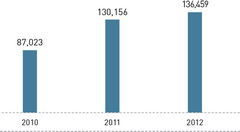

The fact that some of the Company’s subsidiaries began to employ the return on invested capital method (RAB) for tariff regulation was the main contributor to increased capital investment, which enabled subsidiaries to raise the value of their capex programs and expand their network connection services, including for customers qualifying for preferential terms. Capital investment in 2012 grew by 4.8% on 2011.

CHANGES IN CAPITAL INVESTMENT UNDER THE CONSOLIDATED INVESTMENT PROGRAM FOR 2010–2012 (RUBLES IN MILLIONS, EXCLUSIVE OF VAT)

Скачать в XLS

Скачать в XLS CHANGES IN COMMISSIONED CAPACITY UNDER THE CONSOLIDATED INVESTMENT PROGRAM FOR 2010–2012 (MVA AND KILOMETERS)

Скачать в XLS

Скачать в XLS BREAKDOWN OF FINANCING SOURCES FOR INVESTMENT PROGRAM IN 2010–2012 (RUBLES IN MILLIONS, INCLUSIVE OF VAT)

| Source | 2010 | 2011 | 2012 | |||

|---|---|---|---|---|---|---|

| Tariff-based revenues | 38,759 | 41.5% | 59,728 | 45.9% | 58,107 | 39.1% |

| Borrowed funds | 15,929 | 17.1% | 37,116 | 28.5% | 35,849 | 24.1% |

| Connection fees and other sources | 37,213 | 39.9% | 26,533 | 20.4% | 44,929 | 30.2% |

| Additionally issued shares | 1,450 | 1.6% | 6,779 | 5.2% | 9,693 | 6.5% |

| Financing (million rubles, inclusive of VAT) | 93,351 | 100% | 130,156 | 100% | 148,577 | 100% |

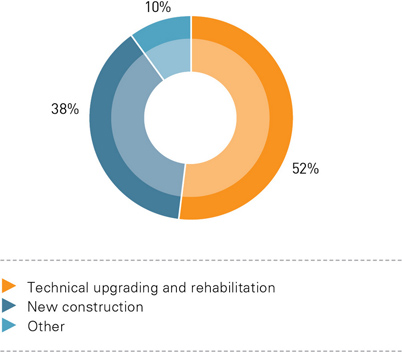

The principal financing sources for the 2012 investment program were tariff-based revenues (39.1%), borrowed funds (24.1%), additionally issued shares (6.5%), connection fees and other sources (30.2%).

AREAS AND STRUCTURE OF CAPITAL INVESTMENT UNDER THE CONSOLIDATED INVESTMENT PROGRAM (RUBLES IN MILLIONS, EXCLUSIVE OF VAT)

| Areas of Capital Investment | 2010 | 2011 | 2012 | ||||

|---|---|---|---|---|---|---|---|

| 1 | Technical upgrading and rehabilitation | 44,947 | 51.6% | 76,015 | 58.4% | 74,985 | 52.2% |

| 2 | New construction | 37,162 | 42.7% | 50,664 | 38.9% | 54,497 | 37.9% |

| 3 | Other | 4,915 | 5.6% | 3,476 | 2.7% | 14,190 | 9.9% |

| Total | 87,023 | 100% | 130,156 | 100% | 136,459 | 100% | |

In 2012, the principal areas of capital investment were technical upgrading and rehabilitation (54.7%) and new construction (39.9%).